Additionally, you might have to pay penalties and charges relying on the state regulation. no-fault insurance. Constantly ensure you're updated on your insurance policy settlements, so if you slipped up and failed to pay the renewal cost for your plan in time, you'll require to speak to the service provider of your vehicle insurance coverage asap to get this taken treatment of.

sr-22 insurance insurance coverage insurance sr22 coverage

sr-22 insurance insurance coverage insurance sr22 coverage

You ought to get quotes from a range of insurer as well as contrast them. Keep in mind as well that you might need to look at several car insurer prior to you find what's suitable for you. The more auto insurance provider you examine, the most likely you'll discover the most effective rates for you.

Doing this prior to getting quotes means you might need to pay even more ahead of time, yet it's worth it because this will certainly save you from having actually coverage attached with an expensive price tag. One of one of the most effective means people can obtain cheaper prices is by looking around as well as comparing different brand names' offers on their internet sites or with phone telephone calls. insurance coverage.

What If I Need SR22 Insurance Yet Relocate or Browse Through Another State? As stated in the past, there are 8 states that do not utilize SR22 certificates to reinstate licenses.

Examine This Report on Frequently Asked Questions - Insurance Requirements - Nh.gov

Relocating from one state to an additional could result in needing the same degree of duty as if your traffic crime had actually been devoted there. The way this works can differ relying on what type of violation was devoted, but commonly nationwide insurance coverage will be needed for out-of-state filings.

An SR-22 isn't actually vehicle insurance. SR-22 is a form your insurance provider sends out to the state's DMV showing that you lug the minimum required Obligation coverage. Generally, an SR-22 is submitted with the state for 3 years (no-fault insurance).

If your SR22 vehicle insurance coverage policy is terminated, gaps or ends, your car insurer is required to alert the authorities in your state. (They do this by releasing an SR26 form, which accredits the termination of the policy. sr22 coverage.) Then, your license might be suspended once again or the state may take various other major actions that will certainly restrict your ability to drive.

Failure to preserve your insurance policy coverage might cause you to shed your driving privileges again and your state might take other activities against you - credit score. It's best to maintain the SR22 for the whole mandated period of time. State regulations relating to SR22 car insurance policy requirements can be made complex. That's why it's so vital to obtain trusted information and also assistance from licensed insurance coverage representatives at reliable SR22 insurer.

Not known Factual Statements About Sr-22 Requirement After A Las Vegas Nevada Dui Case

Plus, experienced representatives will certainly have the ability to aid you discover an accepted affordable SR22 insurance plan. If you have a lot more inquiries concerning SR22 insurance coverage or any other products or solutions, drop in a Direct Auto Insurance policy area near you or call an agent at 1-877-GO-DIRECT (1-877-463-4732). sr-22. At Direct Car, you can get the budget friendly automobile insurance insurance coverage you need, the services you want, and also the regard you deserveregardless of your insurance coverage history.

An SR-22, frequently described as SR-22 insurance coverage, is a qualification issued by your vehicle insurance policy business supplying evidence that you carry the required minimum quantity of lorry liability insurance coverage for your state. If you have been associated with an accident as well as were not carrying minimum vehicle insurance coverage, the majority of state DMVs will need you to submit an SR-22.

If a chauffeur is called for to carry SR-22 and also he or she transfers to one of these six states, they have to still proceed to fulfill the needs legally mandated by their former state. All cars in Washington and also Oregon have to lug a minimum liability insurance plan. insurance. If a Washington chauffeur has his or her permit put on hold, the chauffeur should supply proof of financial duty by filing an SR22.

It is highly recommended that the insured restore their plan at least forty-five (45) days ahead of time. There are two (2) means to prevent needing to get an SR-22 Washington endorsement. A driver can make a deposit of $60,000 to the State Treasurer or obtain a surety bond with a surety firm such as Vern Fonk that is licensed to do company in Washington and also Oregon.

The smart Trick of What Is Sr22 Insurance? – Your Guide To Sr-22 ... - Way That Nobody is Talking About

sr22 coverage motor vehicle safety division of motor vehicles vehicle insurance dui

sr22 coverage motor vehicle safety division of motor vehicles vehicle insurance dui

A chauffeur can not simply show his insurance coverage card as evidence. The insurance policy card will be called for by Oregon regulation, to be existing in a car that is operated on Oregon freeways. The DMV closely checks compliance with SR22 demands, and also if the insurance coverage lapses, the insurer by law is required to notify the DMV of that fact and also the vehicle driver's certificate will be suspended.

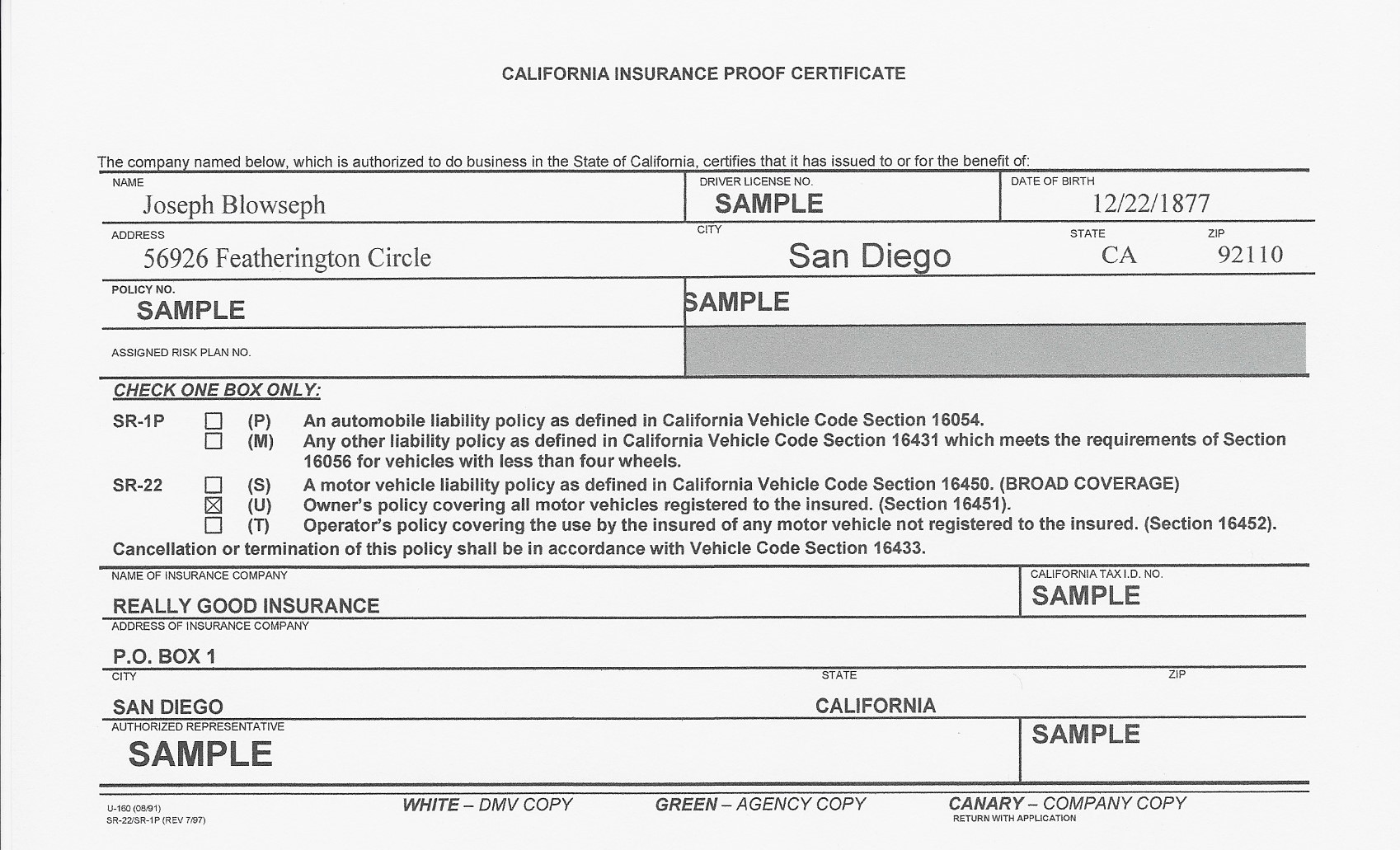

Call Matin Insurance Services (MIS)for help in acquiring the SR-22 insurance policy paperwork you require to return on the road - motor vehicle safety. A The golden state SR-22 confirms the date the vehicle driver acquired the insurance coverage along with the type of coverage. You're called for to document every one of the automobiles you drive when finishing your SR-22 type.

That being said, you should anticipate a boost in your insurance policy premiums. Whether you have a without insurance crash, several website traffic violations, or a DUI, you are considered a high-risk driver, which leads to higher prices - sr22 insurance.

insurance insurance group insurance insurance coverage auto insurance

insurance insurance group insurance insurance coverage auto insurance

You need to maintain sufficient insurance coverage for the whole time for the SR-22 to be legitimate. It's not needed to submit yearly; nonetheless, if your insurance coverage is terminated for any type of factor, your license will certainly be suspended again. You have to reveal consistent nonstop protection for the duration of your called for SR-22 duration for it to be legitimate.

How New York Sr-22 Insurance can Save You Time, Stress, and Money.

Simply put, the SR-22 claims that you're responsible for paying an optimum of $15,000 each to cover bodily injury with an optimum of $30,000 per accident. You're also covered for a maximum of $5,000 in residential property damages per crash - ignition interlock. The point of the SR-22 is to show monetary obligation in the event that you are included in a crash.

Depending on the type of vehicle you drive or your properties, you may want to take into consideration lugging over the above restrictions. If you were issued an SR-22 in The golden state, it is only legitimate in that state.

You are called for to complete every one of the essential documents for the state to which you're moving. As soon as you meet the requirements for the brand-new state, such as obtaining both proper obligation insurance coverage and an SR-22 kind, inform The golden state and also demand an SR-22 release. It's crucial that you do not have any type of gap in coverage.

MIS partners with well-known and reputable insurance companies who have a strong history of economic safety and also devotion to client contentment. We supply you with each business's details so you can make the final, well-informed choice - division of motor vehicles. When you're called for to show SR-22 paperwork to the DMV, MIS reaches deal with partnering you with the right insurance companies.

The Of Sr-22 In California - Bankrate

insurance auto insurance credit score insurance group division of motor vehicles

insurance auto insurance credit score insurance group division of motor vehicles

Our insurance policy quotes are constantly complimentary. Defense through the best insurance provider with the least expensive prices. When Insurance Provider Compete, You Win!.

Nevertheless, if the cars and truck is not covered by collision as well as comprehensive protection, simply make certain you can manage to change the automobile if an accident occurs. Other means to conserve cash on your premiums so you take advantage of economical SR22 insurance is by choosing for a greater insurance deductible. Your month-to-month price is reduced when you select a high insurance deductible, however you'll need to pay more out-of-pocket if you are in an accident.

If you just recently got a DRUNK DRIVING, after that you may be needed to carry SR22 insurance coverage for the drunk driving - car insurance. It is essential to recognize state SR22 needs, including when as well as exactly how to submit it, in addition to when you can remove it. What Is SR22 Insurance DUI? SR22 insurance coverage is a certificate of economic responsibility.

An SR22 is in some cases used to renew a driver's certificate following a suspension that includes a drunk driving fee. underinsured. The kind itself proves that you have the minimum insurance coverage required by your state legislation. SR22 may also be referred to as: Certificate of Financial Duty, SR-22 Bond, SR-22 Kind, SR22SR22 is not a type of insurance.

The 10-Minute Rule for Sr-22 And Auto Insurance After A Dui/dwi/owi Arrest

In some states, you may also have the ability to obtain it from your insurance coverage carrier. While an SR22 is generally needed when a chauffeur receives a drunk driving charge, it may also follow various other sorts of costs. A few of these include driving without insurance policy, a high incident of crashes or moving violations, and a challenge certificate.

Your insurance coverage firm will additionally factor in your age, area, driving record, and credit rating rating. In enhancement to submitting an SR22, some states might additionally need drivers founded guilty of a DUI to also complete a driver safety and security course to restore their license.

On average, many states require motorists with a DUI to submit an SR22 for 3 years after their costs (insurance). Depending on the number of Drunk drivings on your record, your state might need you to file an SR22 for life.

underinsured sr22 insurance sr22 coverage motor vehicle safety insure

underinsured sr22 insurance sr22 coverage motor vehicle safety insure

When your time limit is up, it is essential to note that the SR22 will certainly not just fall off your record on its very own. Rather, you will have to demand that your insurance company remove the form.

The Buzz on Sr-22 (Insurance) - Wikipedia

This is referred to as a non-owner SR22 form. Also if you just have accessibility to a household vehicle, you may still consider obtaining a non-owner SR22 plan. Transferring to a Different State with an SR22 Form, Due to the fact that state regulations differ when it concerns a DUI as well as SR22 forms, you will certainly require to research your brand-new state's demands if you relocate. insurance.

In these states, they may have their very own version of the SR22 types or they may just require that you offer evidence of insurance coverage. Exactly how to File an SR22 FormSubmitting an SR22 type is straightforward (sr-22). When you submit it to your insurer, they will certainly include the insurance policy recommendation to your plan and inform the state that you have sufficient insurance.

Below are a few insurance provider that do use SR22 policies: Mercury, GEICOUnited, CSAAFarmers, Allstate, Progressive, State Ranch, It is constantly a good idea to be straightforward when asking for quotes from insurance companies. An SR22 is likely to have some impact on your prices implying you will get one of the most precise quotes when you review it upfront.

Buying around is just one of the very best ways to obtain the most affordable prices, also with an SR22. Locate out just how much each supplier will cost you, contrasting the degree of coverage supplied with the price. Furthermore, locate out if you are eligible for any type of price cuts which can reduce your insurance policy expenses even a lot more.

The Ultimate Guide To Sr22 Insurance

Certain drivers in Ohio will need to acquire an SR-22 from a licensed car insurer eventually throughout their lifetime. Contrary to preferred belief, an SR-22 is not an insurance coverage policy - no-fault insurance. It is a certificate that verifies you carry Informative post the minimum necessary insurance coverage in the state, as well as it is typically necessary if you have a negative strike on your driving record.

If your motorist's permit is suspended as well as you are called for to acquire an SR-22 certificate, it is very important to understand exactly how it will impact your driving record as well as your auto insurance coverage price. sr22 insurance. Keep checking out to learn even more about SR-22s in Ohio, exactly how much they set you back and also the length of time the requirement to have one remains on your record.